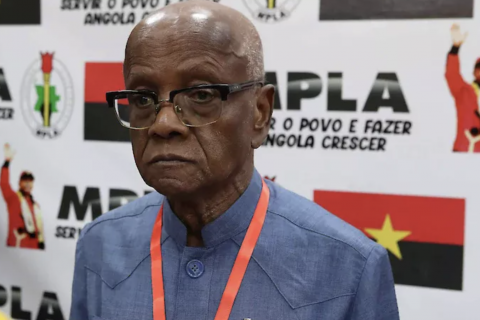

The governor of the National Bank of Angola (BNA), José de Lima Massano, spoke at the presentation of the decisions taken at the ordinary meeting of the Monetary Policy Committee (CPM), which analyzed the recent behavior of the main economic indicators and decided on the leading rates to influence price stability in the economy.

"The solvency and external stability of the economy was assured. The volume of imports has been reduced, and I would like to highlight food, where since the beginning of the program to date, we have had an average drop of around 40 percent," he said.

According to José de Lima Massano, in 2020, in relation to 2019, there was a drop of nearly 23 percent in food imports, which were replaced by national production.

"We have not had alarming situations of scarcity of products and we see in our daily lives, at home, we have more national products, we look for more national products. It is one of the benefits that we have, from those that we are pursuing, more national products means to value more what we do, more jobs, more competitive economy", he said.

José de Lima Massano considered good the news about the national currency, which was even overvalued around 70 per cent, but since the end of October last year until now it has remained stable.

According to José de Lima Massano, the overvaluation of the kwanza not only caused high pressure on international reserves, but also took away any sense from national production, "because it was cheaper to import than to produce.

The communiqué issued by the CPM states that, in the foreign exchange field, there was an increase in the degree of coverage of imports of goods and services by international reserves from 9.3 months to 12.2 months, as well as a reduction in the differential between the exchange rates practiced in the formal and informal markets from 22.97 per cent in 2019 to 14.4 per cent in 2020.

The artificial overvaluation of the kwanza against the currencies of Angola's main trading partners was also eliminated, with the gap in the real effective exchange rate remaining within equilibrium, the communiqué also highlights.