According to the Center for Global Development Policy at Boston University, China has lent more than 45 billion dollars to Angola from 2000 to 2022.

Angola is the largest recipient of Chinese financing, followed by Ethiopia, with 14.1 billion dollars, and Kenya, with 9.7 billion dollars since the beginning of the century.

In the case of Angola, and also according to this renowned study center on the economic and financial relationship between China and Africa, financing is largest in the energy sector, with 26 billion dollars in 37 loans, but it is mostly in the transport sector, with 6.2 billion dollars channeled to 67 projects.

In total, according to data from this centre, which is generally recognised as the most comprehensive source of economic and financial information on relations between the two blocs, since the beginning of this century the Asian giant has lent 170 billion dollars to 1243 initiatives.

Of this total, almost 60 billion dollars were channelled into energy projects and almost 50 billion went to projects in the transport sector.

Despite still being the largest partner of the African continent, Chinese financing to African countries fell to less than one billion dollars in 2022, the last year for which data is compiled, representing the lowest value in almost two decades.

Since the peak of 28.5 billion dollars reached in 2016, in 2021 China made only seven loans worth 1.22 billion dollars, and in 2022 the value fell to 994 million dollars, with only nine loans, the lowest level since 2004.

"The Covid-19 pandemic influenced these figures, but much of the decline can be explained by the reduction in the level of exposure" to the evolution of African public finances, commented the researcher at this center and one of the managers of the center's databases on this topic, referring to the deterioration of the economic situation of African countries following the pandemic, which deepened already existing difficulties and forced several countries to renegotiate the terms of Chinese loans, with some, such as Zambia and Chad, entering into Financial Default.

In the specific case of Angola, China offered a two-year moratorium on loan repayments in 2021, and this year it agreed that part of the funds deposited in a loan repayment guarantee account could be used to help the country meet its financial obligations.

In addition to the investments made by China, the debt owed by the second largest oil producer in sub-Saharan Africa to the Asian giant is equivalent to around 40 percent of all external debt, amounting to around 17 billion dollars, the Finance Minister said at the beginning of the summer.

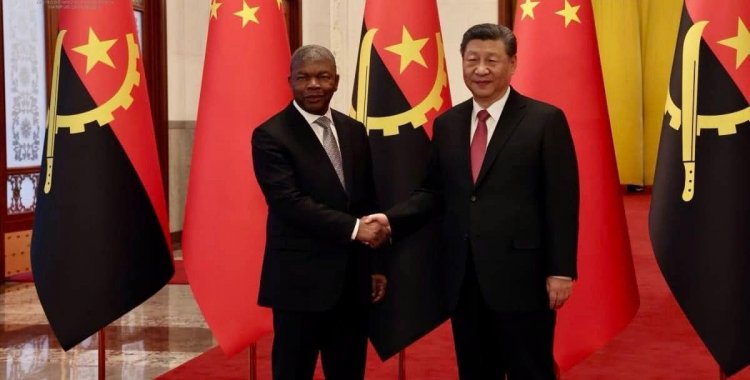

These issues, debt, investment and the relationship model will be debated at FOCAC 9 this week, which this year has the theme 'Join Hands to Advance Modernization and Build a High-Level Sino-African Community with a Shared Future'.

The forum will take place from 4 to 6 September in Beijing, with technical meetings starting this Monday and will be attended by Chinese President Xi Jinping and delegations from the African Union and dozens of African countries that maintain diplomatic relations with China", according to the Chinese Ministry of Foreign Affairs.