"In a context in which the State cannot go all out in supporting public companies, that is, as a general principle of reducing the State's participation in the economy by handing over companies, such as Unitel, which have an important role to play in the respective sector, I agree with anything in this direction", said Alves da Rocha in an interview with Lusa.

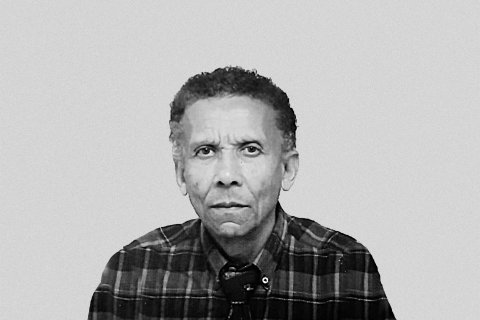

The economist and director of the Centre for Studies and Scientific Research (CEIC) at the Catholic University of Angola, stressed that it is important that the details of the Unitel privatisation deal be known.

"The details are important. Since the State has nationalised Unitel and is now going to put the company in the private sector, we need to know the details of the deal", he said.

He also considered that the Government's Privatisation Programme (ProPriv), which is part of a global strategy promoted and advised by the International Monetary Fund (IMF), is a good start, especially to boost the private sector.

Because "I am not one of those who uncritically share the idea that everything managed by the State is bad and everything managed by the private sector is good, I do not share this idea in a certain abstract way", he stressed.

"I do share the idea that the economy should be handed over to the private sector and the State should take steps to establish legal and institutional frameworks and ensure a good business environment, something that does not exist in Angola at the moment, because there are still many deficiencies in the functioning of the economy", concluded the researcher.

The Government will privatize 15 percent of the share capital of the telecommunications operator Unitel, with 2 percent of the shares being reserved for employees and members of the company's corporate bodies, according to a presidential order.

The shares representing 15 percent of Unitel's share capital will be privatized via an Initial Public Offering (IPO), an operation that will be handled by the Angolan Debt and Stock Exchange (BODIVA).

President João Lourenço, in a ruling published in the Official Gazette on 23 August, authorised the reservation of 2 per cent of shares for acquisition, "under special conditions", by employees and members of the company's corporate bodies, in accordance with the law.

The State announced in early July that it would also reduce its holdings in the insurance company ENSA, Standard Bank and Bodiva by November of this year.

In light of ProPriv, the State intends to sell, by November, 34 per cent of the 49 per cent stake it holds in the South African Standard Bank, 24 per cent of which will go to the partner shareholder and 10 per cent on the stock exchange, with 15 per cent remaining in the State's hands.

Initially planned for the period 2019-2022, with a total of 195 public assets to be privatized, ProPriv was extended for the period 2023-2026, through Presidential Decree No. 78/23 of March 28.