Standard Obrigações aims to provide participants with the possibility of accessing a portfolio made up of medium-term assets, with a view to increasing the value of the investment higher than that obtained in traditional financial products. Standard Tesouraria aims to preserve the capital invested and offer its participants a liquidity reserve, that is, a product with immediate liquidity and a return in line with very short-term assets, simultaneously giving access to a diversified portfolio.

In partnership with Standard Bank of Angola, Standard Invest – Sociedade Distribuidora de Valores Mobiliários, and Lwei Mansa Musa Brokers – Sociedade Corretora de Valores Mobiliários, SGA began, on June 3, the marketing of participation units (UP) of these two new FEIVMA. On June 14th, SGA began setting up and managing the investment fund's portfolio, investing the amount initially raised in different financial instruments.

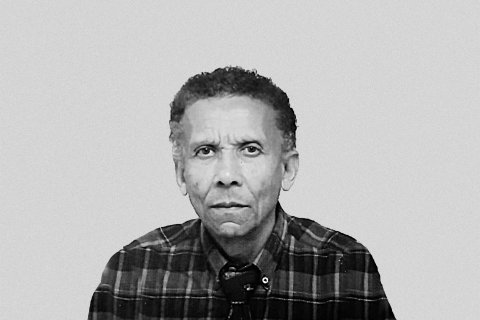

"The Angolan investor now has more investment options, confirming SGA's commitment to contributing to the construction of a diversified offer of instruments in our capital market. We strongly believe that the two FEIVMA are complementary investment vehicles, with the potential to increase profitability and diversify our investors' portfolios, through our professional management, as has happened with Standard Rendimento", said António Catana, CEO of Standard Gestão de Activos.

The Standard Obrigações and Standard Tesouraria Investment Funds are permanently available for new subscriptions, reinforcements (increases) and redemptions (exits), guaranteeing everyone the opportunity to invest according to their needs and schedule, through the website (www.standardga.co.ao) or the application (StandardGApp).

"We will remain confident in the coming challenges, with the prospect of becoming effective as a GPS for investments in Africa, democratizing access for all Angolans to the best investment opportunities", concluded António Catana.