The pilot project will be limited to the province of Luanda for one year, with over 10 million inhabitants, and aims to reach over 200,000 people in this phase.

Reinforcing confidence in the Angolan financial system, promoting the responsible use of technology in the virtual world and changing the approach to cyberbullying, digital security and proper use of social networks to create greater resilience to payment fraud are also among the project's objectives.

According to the president of The Bridge Global, Leonor de Sá Machado, who presented the project, it is aimed at adults, children and young people, considering that the initiative, already underway, "is also reaching the communities".

"The methodology used is to create a progressive evolutionary concept that triggers a multiplier action on all targets, guaranteeing the project's longevity over the years", she explained.

In the initial phase of this project "we will only be in Luanda, we think at this stage until March 2023 to reach 100 thousand people and by the end of the year see if we manage to reach 200 thousand people, the idea is to have that objective that I think should be surpassed in this period", she stressed.

José Matos, chairman of the executive committee of EMIS, admitted, during the press conference, that the investment of 150 million kwanzas will have "a great return" for the company.

"Because, we are convinced that it will end up translating into greater confidence in the use of payment instruments, it will also contribute a lot to the reduction of costs associated with fraud", he replied to Lusa.

And the chairman of the board of directors of EMIS, Pedro Nuna, stressed that the initiative reflects the company's concern to "transmit to the population, not just bank customers, the need to always stay informed".

"And maintain maximum security in relation to the financial instruments they use, such as electronic payment systems in order to defend themselves against fraud", he stressed.

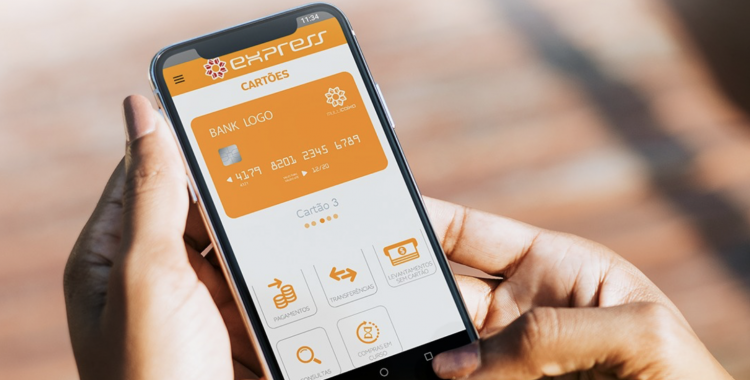

The "Cidadão Digital", which will be multiplied in schools, universities, ministerial bodies and other public and private institutions, inscribes notions on the use of the "multicaixa" Debit Card, Automated Teller Machine, Automatic Payment Terminal (TPA), Multicaixa Express and Online Payments.

The Multicaixa Network in Angola currently has around 3100 ATMs, more than 150 thousand Automatic Payment Terminals, around 6.7 million payment cards and aggregates more than 700 thousand users of the Muticaixa Express channel.

EMIS assumes the commitment of "maintaining the growth of the network to achieve the total dematerialization of payments in a sustained manner, with the highest standards of service levels to which the population has already become accustomed".