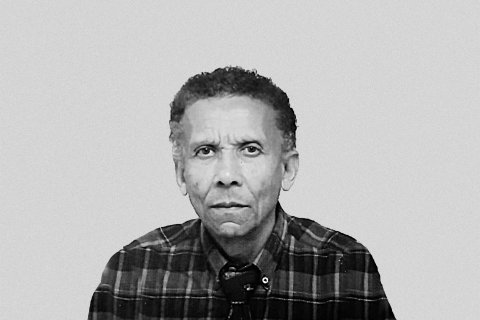

"We started with a closed fund, with 125 clients, and currently we have 500 clients. Under management we have close to 15 billion kwanzas and we are convinced that, by the end of the year, we will double this amount. A conviction that has to do with the fact that we see more and more customers interested in this solution. Because, effectively, we are offering something that does not exist on the market. SGA came to change the market in Angola", said António Catana, CEO of Standard Gestão de Ativos.

After making available, in March, the Standard Rendimento – Special Investment Fund in Closed-Ended Securities, the SGA presented, in June, the two Special Investment Funds in Open-Ended Securities: Standard Obrigações and Standard Tesouraria.

"Our funds currently have approximately 15 billion kwanzas. And since we started our activity, in six months, we have already made transactions on BODIVA, based on these 15 billion kwanzas, out of 90 billion. We are clearly able to take advantage of the opportunities that are on the market. And this is only possible through systems, the right people and knowledge", said the CEO of SGA.

Emphasizing that the institution is "managing to deliver the best returns to clients", Antonio Catana said that the Special Closed Securities Investment Fund, started in March, is having a return of 25 percent.

"It's not that it's a standard for the future, but it was proof that whatever money is on the table, our managers will take that money for our clients. There is no limit to clients making money with us. We will naturally always make a rigorous risk management, but we will also always enhance our customers' profitability", he highlighted.

With regard to Special Investment Funds in Open-Ended Securities, Standard Obrigações aims to provide participants with the possibility of accessing a portfolio made up of medium-term assets, with a view to increasing the value of the investment higher than that obtained in traditional financial products. Standard Tesouraria aims to preserve the invested capital and offer its participants a liquidity reserve, that is, a product with immediate liquidity and a return in line with very short-term assets, simultaneously giving access to a diversified portfolio.

The Standard Obrigações and Standard Tesouraria Investment Funds are permanently available for new subscriptions, reinforcements (increases) and redemptions (exits), guaranteeing everyone the opportunity to invest according to their needs and schedule, through the website (www.standardga.co.ao) or the application (StandardGApp).

SGA intends to be the partner in accessing capital market opportunities for all Angolans, regardless of where they have their bank accounts domiciled, through its own marketing channels or through the establishment of partnerships with other entities.