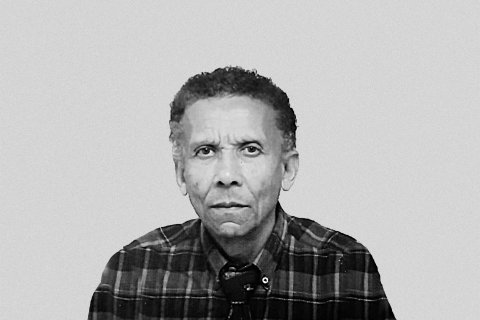

Speaker at the panel discussion 'New forms of investment and capital financing', part of the Forbes Lusophone Africa Annual Summit 2024, in Luanda, António Catana said that, with primary market rates at around 15 percent and secondary market rates at 18 percent, there is a "fantastic opportunity for companies to enter the market".

"With rates below 20 percent, they can find investors. It is not normal to have such high inflation, at 29 percent, and to have conditions to issue at 18 percent. The sustainability of public debt has opened up a huge opportunity for private companies. If the State were issuing at rates of 25 percent, this opportunity would not exist. Since the State is managing its accounts well, it opens up space for private companies. It is a unique window that must be taken advantage of", argued the CEO of SGA, part of the Standard Bank Group.

Regarding the capital market and its reinvention, António Catana highlighted that the Standard Bank Group identified in Angola "opportunities to do different things". "That's what we are doing: offering the best opportunities in the capital market to all Angolans. Namely through technology, where we started with an app. At the moment we even have several private clients who, through this app, already subscribe to our funds, according to their risk profile".

For the CEO of SGA, democratizing access to the capital market involves "managing to gain the trust of Angolans, showing alternatives that are more competitive than traditional products in terms of profitability, and providing simplified access to everyone".

"At the moment, at Standard Gestão de Activos and the Standard Bank Group, we are implementing a philosophy in which we view the market as a global market. For example, there is a huge space for the real estate investment fund market. And what the stock market is currently lacking is a stock fund. This issue of having different specialized players who can capitalize on savings and help Angolans invest in the best opportunities is the way forward".

Backed by the solidity and knowledge of the largest financial group on the African continent, Standard Gestão de Activos' mission is to provide access to the best investment opportunities, through a team of specialists and the most innovative digital technology.

Based on careful analyses, the SGA team structures investment funds, especially real estate funds, to meet the needs and objectives of clients, offering an ideal balance between risk and return, and a practical and efficient solution to increase the value of savings, allowing them to take advantage of the growth of the financial markets with peace of mind and security.