The person responsible, in statements within the scope of a meeting that brought together clients from the SME segment in Angola and members of the executive management of SME Banking from the Standard Bank Group and Standard Bank of Angola, highlighted the "credit portfolio with more than 100 million dollars for SMEs, with emphasis on the Agriculture, Oil & Gas and Commerce sectors".

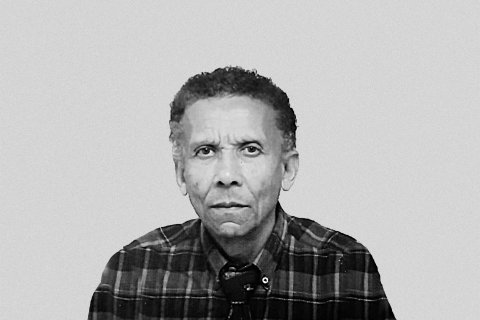

"The SBA has already financed approximately 200 million dollars to promote local production, in compliance with notice 10 from the National Bank of Angola", highlighted Fernando Chivinda, who, quoted in a statement sent to VerAngola, praised the "mission and commitment of be side by side with local content SMEs and be the main financial partner for local companies seeking sustainable growth, supporting the development of the economy."

According to the note, the Small and Medium Enterprises (SME) Banking team, from the Standard Bank Group, was in Angola for the first time to strengthen the relationship with the market and reaffirm the commitment to the growth of Angolan SMEs. The delegation's visit began last Monday and ended this Wednesday, including meetings with customers, partners and businesspeople, as well as a meeting with the Secretaries of State for Industry and Commerce and Services.

"One of the highlights of the agenda was the cocktail promoted" on Tuesday and which brought together "clients from the Small and Medium Business segment in Angola and the members of the Executive Board of the Group's Small and Medium Business Banking and Standard Bank of Angola (SBA)", reads the statement.

"With this visit we intend to better understand the reality, the market and customers in Angola, with a view to strategically assisting the sustainable growth of their businesses", explained Bill Blackie, CEO of Standard Bank Group's Small and Medium Enterprises.

At the event, "the Group's strategy for the Angolan market and the innovative and personalized solutions offered to customers to boost business growth" were presented, as well as the "expectations and prospects for the Angolan market in 2025" were discussed.

On the occasion, Luís Teles, CEO of the SBA, said that to promote the country's growth, "nothing is better" than supporting companies: "To promote Angola's growth, there is nothing better than supporting companies. They are the ones who work every day to make this economy grow. And our role is precisely to help companies do this work. We want to be a multiplier of economic development, supporting companies' projects and activities."

The Standard Bank delegation also visited "some of the bank's main clients, to learn about their businesses and needs, such as Africa Pharmacy, Sogeplast, Kikolo, WellScope, Anseba, CB&B, Angonura and Mafcon".

Furthermore, the delegation also held a meeting with the Ministry of Industry and Commerce, having been received by the Secretary of State for Industry, Carlos Rodrigues, and the Secretary of State for Commerce and Services, Augusta Fortes, "for a meeting around the needs of the agricultural, trade and renewable energy sectors, considered key areas for Angola's sustainable development", points out the statement.

Luís Teles also said that the group is available to provide support for Angola's economic growth. "The Standard Bank Group is fully available to support the country's economic growth, not only through offering innovative financial products, but also by providing specialist teams prepared to meet the specific needs of Angolan companies. We are focused on supporting SMEs to prosper with financial solutions that respond to current challenges, driving the development of strategic sectors", said the SBA CEO.

"Another of the topics covered was the role of Standard Bank as a facilitator of connections between Angolan companies and other African markets, thanks to its presence and network across the continent, strengthening intra-African trade and promoting strategic partnerships that can boost the growth of SMEs in Angola", says the note, which says that the meeting was attended by Bill Blackie, CEO of Small and Medium Enterprises of the Standard Bank Group, Tunde Macaulay, director for Small and Medium Enterprises in African and Offshore Regions, Luís Teles, CEO of SBA, and Fernando Chivinda, executive director of Small and Medium Enterprises at SBA.

The program for the visit to the country also included a meeting with "SBA employees to present the business results in 2024 and the strategy and perspectives for the future".