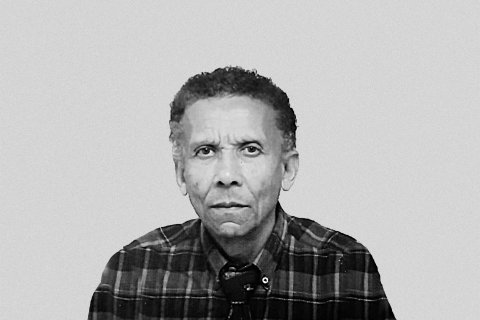

The deputy governor of the BNA, Pedro Castro e Silva, said that the control of beneficial owners (people who own, control or benefit from a legal entity, such as a company, fund or other legal structure) is a recommendation of the International Monetary Fund (IMF) and the Financial Action Bureau (FATF).

The construction of the national database on beneficial owners – within the scope of the fight against money laundering and terrorist financing – is the responsibility of the Angolan executive, Castro e Silva continued, in statements made at the end of the 119th meeting of the BNA Monetary Policy Committee.

"Regarding beneficial owners, it is not only a recommendation of the IMF, but also of the FATF so that we know who the ultimate beneficiaries are of various types of operations, such as money transfer operations", he responded to journalists.

Pedro Castro e Silva noted that from the point of view of banking regulations, there are requirements that banks must follow in order to obtain maximum information about who orders a particular transaction and who the beneficiary is.

"We are somewhat satisfied, but not completely. We will be completely satisfied when there is this national database on beneficial owners, which is a responsibility that does not fall to the BNA", he stated.

He also stated that the Agrarian Development Support Fund (FADA) is an institution under the jurisdiction of the Angolan central bank, acknowledging, however, the institution's lack of a history of reporting.

He argued that the BNA has carried out several inspections of FADA – which has a credit portfolio of 80 billion kwanzas to finance the Family Farming Acceleration Program in Angola and the Strengthening of Food Security for the three-year period 2024-2026.

In addition to these inspections, the official continued, "we are also monitoring a plan that the institution is implementing to comply with regulatory requirements, and these requirements clearly include the reporting of accounts".

"It is a non-banking financial institution that has deserved our monitoring for these reasons, not only from the point of view of the preparation and reporting of prudential information, but also compliance with other types of rules, including those related to combating money laundering and terrorist financing, and we share this concern", concluded Pedro Castro e Silva.