Speaking to Lusa, on the sidelines of the 3rd edition of the Angola Economic Outlook, minister Vera Daves said that the agreement in principle provides for a renewal every 12 months, allowing the Angolan Treasury to reduce the guarantee reserve (escrow account) and thus have between 150 and 200 million (182 million euros) per month from this account until the end of the financing maturity.

This account refers to financial resources that are deposited in the creditor bank to ensure compliance with Angola's commitments to China.

According to Vera Daves, Angola will also pay off its debt more quickly as whenever the price of a barrel of oil is above 60 dollars, the State can make additional payments.

The agreement with the China Development Bank was negotiated in March and the Minister of State and Economic Coordination said at the time that the effects of this relief would be felt from April onwards.

This Tuesday, José de Lima Massano guaranteed that the effects of the agreement with Chinese creditors on public accounts are already being felt.

"We were forecasting an inflow of funds of 200 million dollars and we had triple that, this allowed us, in the relationship with our creditors, in the management of public debt, to have the capacity to honor our responsibilities with our own funds", the government official told journalists.

In other words, "there was no pressure on the internal and external market to fulfill these responsibilities and this leads to the release of more resources from the economy to support the private sector", he explained.

Lima Massano noted, however, that although on the economic side "the signs" of relief are already visible, the impact on people's lives "does not happen overnight".

The People's Republic of China is Angola's main creditor, with 17 billion US dollars, representing around 27.41 percent of the government debt stock, which is 62 billion dollars.

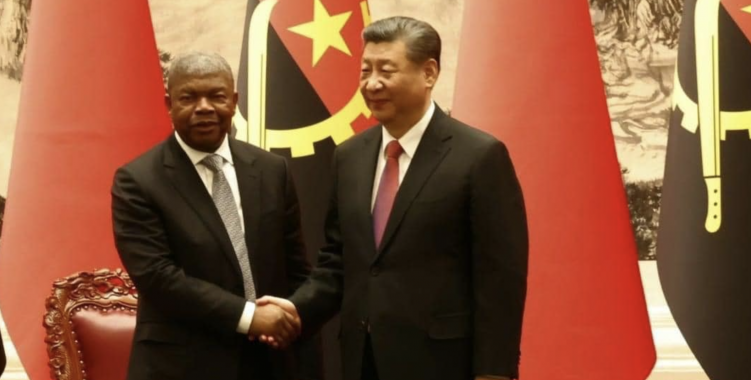

Luanda managed, during President João Lourenço's visit to Beijing this year, to conclude agreements with Chinese creditor institutions to make the model for creating guarantees based on oil supply more flexible, in relation to 10 billion dollars contracted with the Bank of Chinese Development (CDB).

The agreement reduces the volume of the guarantee reserve (escrow account), made up of the surplus between the supply of oil and the amount needed to service this debt, the calendar of which remains unchanged, explained the Angolan Treasury at the time.

New rules come into force for the Chinese release of escrow account balances, allowing the Angolan Treasury to have an additional 150 to 200 million dollars available monthly.

The Angola Economic Outlook 2024, organized by the magazine Economia e Mercado, is dedicated in this edition to the theme "Food Security: Reality, Challenges and Opportunities".