Founded in September 2023, and having launched three investment funds in 2024 – one closed and two open –, Standard Gestão de Ativos currently has a portfolio of 424 participants and around 17.95 billion kwanzas under management.

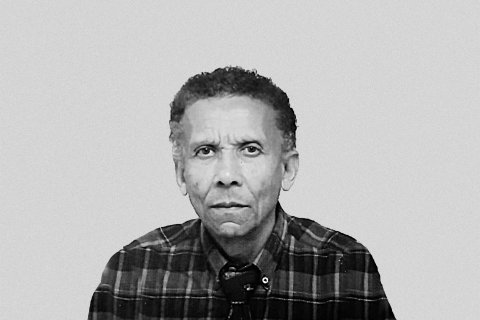

"We started with a closed fund, with 125 participants, and we currently have 424 participants. We have around 17.69 billion kwanzas under management and we are convinced that, by the end of the year, we will significantly increase this amount. A conviction due to the excellent performance of our funds, well above the defined benchmarks, and by the growing number of investors interested in this solution", highlighted the CEO of SGA.

According to António Catana, the 'Standard Rendimento' Investment Fund, with a global net value of around 10.46 billion kwanzas, has an annualized net profitability of 35.84 percent. The 'Standard Obrigações' and 'Standard Tesouraria' present, respectively, annualized net profitability of 18.74 percent and 11.64 percent.

"SGA came to change the market in Angola", said António Catana, adding that the returns delivered to investors "are only possible to achieve with the active management of the portfolios of the respective funds, through the opportunities detected daily in the Bodiva markets, as easily this is proven by the volume of operations transacted on the stock exchange, worth 168 billion kwanzas, approximately 10 times the value of the assets under management".

With regard to Open Investment Funds, the 'Standard Obrigações' aims to provide participants with the possibility of accessing a portfolio made up of medium-term assets, with a view to achieving a higher investment appreciation than that obtained in traditional financial products. The 'Standard Tesouraria' aims to preserve the invested capital and offer participants a liquidity reserve, that is, a product with immediate liquidity and competitive profitability compared to short-term investments.

The 'Standard Obrigações' and 'Standard Tesouraria' Investment Funds are permanently available for new subscriptions, reinforcements (increases) and redemptions (exits), ensuring everyone the opportunity to invest according to their needs and schedule, through the website (www.standardga.co.ao), the App (StandardGApp) or marketing partners.

"Whether through our own marketing channels or by establishing partnerships with other entities, we intend to be the partner that provides all Angolans with access to the best opportunities in the capital market, regardless of their banking institution and location," concluded the CEO of the SGA.