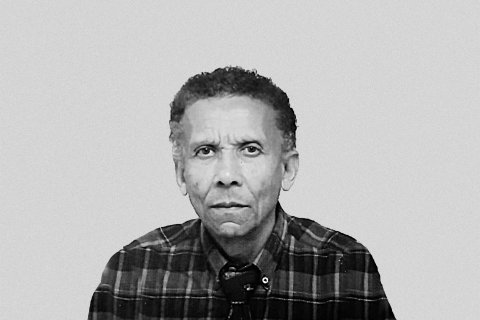

Considering that, from the point of view of economic growth, "2024 has been a year of positive surprises", Fáusio Mussá highlighted "the strong performance of the oil sector in the first half of 2024 and the diamond sector in the second quarter of 2024, which allowed GDP growth to accelerate to 4.3 percent per year in the first half of 2024, compared to 1 percent per year for the whole of 2023"

Regarding next year, Standard Bank's chief economist anticipated a "slowing of GDP growth to 2.9 percent in 2025, and 3.9 percent in 2024, as the growth of oil production slows".

"Regarding economic growth, in addition to the slowdown in GDP, there is a prospect of high inflation, even above 20 percent, because on the one hand it is not very clear what will happen from an exchange rate point of view, given that the expected progress in removing the fuel subsidy could continue to keep inflation high. From the point of view of the global situation, the outlook points to a reduction in the price of oil," he said.

Fáusio Mussá also highlighted that "despite some relief, debt service remains high, which limits fiscal space". "The primary fiscal surplus and balance of payments current account surplus remain critical to help reduce government debt, debt service pressures and improve the supply of foreign currency in the market," he added.

According to data from the III edition of Standard Bank's economic briefing, between June 2022 and June 2024, debt to China reduced by 6 billion dollars, to a balance of 15.9 billion dollars, and is also domestic debt decreasing, as at the end of September 2024, domestic debt (Treasury bills plus bonds) registered a reduction of 11.9 percent year on year to 12 billion kwanzas or 12.1 percent of GDP.

"The Government intends to increase investment expenditure in 2025, which must be accompanied by reforms to help amplify social and economic benefits. The majority of the State's foreign currency revenue, which results from the contribution of the oil sector, continues to be channeled into debt service, which limits sales of foreign currency by the Treasury, and results in a high unsatisfied demand for foreign currency", he explained.

Fáusio Mussá also predicted that, as far as next year is concerned, "it is unlikely that the central bank will decide to sell or dispose of reserves to support the foreign exchange market". "The BNA has limited its sales of foreign currency to protect international reserves. The shortage of foreign currency has resulted in the depreciation of the kwanza and inflation," he added.

For the chief economist, the expected progress in fuel subsidy reform could translate into "inflation that remains high for longer, implying pressures on the cost of living, could translate into a slowdown in GDP growth next year".

The economic briefing is a periodic event created in 2018 by Standard Bank, aimed at the institution's clients, regulators and public institutions, which presents an overview of the macroeconomic situation and prospects for the future of the economy, revealing, on the one hand, a set of positive and favorable developments for the national economy and, on the other, some of the challenges that remain.

"For an economy to grow and create wealth, private sector companies have to invest. Companies are the ones who create wealth, not the State. We cannot continue to believe that the State is the main investor and promoter of projects in Angola. But for private companies to invest, their managers must have confidence in the future prospects of the economy and its predictability", highlighted Luís Teles, CEO of Standard Bank of Angola.

According to Luís Teles, for Angola to grow it is necessary to "have a huge focus on simplifying private investment, on the need to prioritize improving the business environment, on the urgency of having macroeconomic stability, with a focus on the four rates – interest, exchange rate, of inflation and GDP growth –, and a total obsession with attracting foreign investment".

The third edition of 2024 of the economic briefing also featured a panel of debates, dedicated to the theme 'The role of investment in infrastructure in economic growth', with speeches by Danilo Trinchão, financial director of OEC Africa, Daniel Santos, advisor to the Board of Directors of Omatapalo, and Fáusio Mussá, chief economist at Standard Bank.