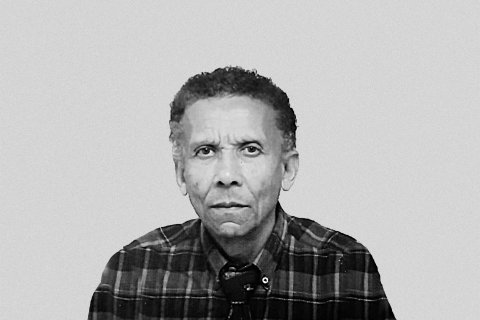

According to the director of the legal office of the Insurance Supervision Regulation Agency (Arseg), Aldemiro Gonçalves, the new Law on Insurance Mediation Activity is a crucial diploma for the reform of the sector, starting in 2022, with the approval of the Law on Insurance and Reinsurance Activity.

Aldemiro Gonçalves was speaking to the press on the sidelines of a Seminar on Insurance and Pension Fund Matters, held this Wednesday at the National Assembly, which served to share with deputies an overview of the financial market, in particular, the insurance market, convey the functioning of these segments, as well as information on the sector's evolution process.

The official stressed that, for the first time, from a legal point of view, 'bancassurance' was enshrined in legislation, that is, that banks can carry out insurance intermediation activities, but in a limited way.

At the time of discussions of this legal document in parliament, deputies were opposed to the proposal for banks to be able to sell insurance, however the law was approved on January 25th of this year, still awaiting promulgation and publication, with some limitations.

According to Aldemiro Gonçalves, banks will only be able to provide 'corporate' insurance, that is, insurance for public institutions and companies, to be carried out by classic intermediaries and not private individuals.

"It means that a citizen cannot go to the bank and ask them to mediate a relationship in which I want to take out health insurance from the insurer. Our objective is with this prohibition to allow this market segment to develop and to guarantee, in a certain way, self-employment for young people who are insurance intermediaries. We leave the banks with the 'corporate' and the private sector with everything that is retail", he explained.

Regarding this prohibition, the person responsible continued, there is an exception, where the bank can provide insurance for individuals, when the insurance is related to a banking service, for example, a bank credit.

Aldemiro Gonçalves stressed that this law guarantees the rules on preventing conflicts of interest in the relationship between banks and customers.

"The first note we must bear in mind is that the participation of banks through 'bancassurance' in the market increases the level of insurance penetration, because banks have a depth and a client portfolio that individuals do not have, but this action by the bank in the market it has to be an action in accordance with best practices", he noted.

The involvement of individuals in the insurance market also aimed to promote self-employment, "through this type of liberal activities", added the director of Arseg's legal office.

"Currently the insurance penetration rate is relatively low, it is below 1 percent of GDP and the set of initiatives we are carrying out are designed to easily overcome this challenge, which, for now, we have", he said.

Currently the insurance market has 23 registered insurers and over 3000 intermediaries, natural persons, a significant number, but still insufficient.

This year, at least two proposed laws must be submitted to the National Assembly, the Proposed Law on the General Regime of Pension Funds and the Proposed Law on the Insurance Contract.