According to Ruth Saraiva, general director of the consultancy ASSERTYS, a company that prepared a Survey on the Quality of Banking Services from the perspective of the User, commissioned by the National Bank of Angola (BNA), Standark Bank leads the service level positively.

The results of the survey, which took place from 9 to 21 January, were presented this Thursday during a conference on “Evaluation of Banking Services from the perspective of the User”, promoted in Luanda by the central bank.

The study carried out in the 18 provinces surveyed 5022 customers, between individuals and companies, noting that the level of service quality "is quite satisfactory, on a frankly positive level".

"But we are not at an excellent level and it is important to work at this level, and in terms of recommendations, the main one is related to the question of the service that is wanted more quickly and effectively", said Ruth Saraiva.

According to the consultant's general director, "this is transversal to the segment of individuals and companies", considering, however, that the level of complaints "at this moment is very low".

Regarding the segment of private customers, the study found a level of complaints around 22 percent and almost 30 percent for companies.

"There are low levels of complaints, which basically justifies the results of our survey, that is, we have just had an acceptable, frankly positive level of quality," he noted.

Among the recommendations, the consultant's responsible defended the "improvement" in the level of service in the banking universe, fluid communication, greater physical space and speed in the internet banking service.

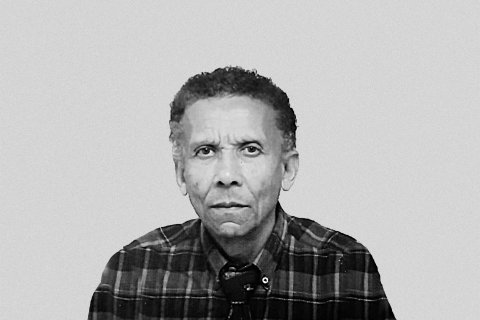

For his part, the director of the BNA's Financial Conduct department, Osvaldo Santos, considered that complaints vary according to the socio-economic reality, pointing to transfers abroad and payment cards, among those arriving at the central bank.

Osvaldo Santos also clarified that complaints from customers and employees of banks closed in 2019, namely ABANC, Banco Mais and Banco Postal must be addressed to the court.

"(...) Because the process is in a judicial phase - at this moment the BNA no longer has any intervention - any claim must be addressed to the court or at a later time to the liquidation commission", he explained.

The conference on “Evaluation of Banking Services Services from the perspective of the User” was the first of 2020, framed in the annual cycle of conferences of the National Bank of Angola.