“In fact, and as required by law, Banco de Portugal has initiated administrative infraction proceedings, which are currently being processed, with a view to investigating and demonstrating evidence, safeguarding the legitimate rights of the defendants, if the situations identified are, or not, liable to generate administrative offense”, reads the clarification disclosed by the regulator and banking supervisor.

“It should be noted that, in the present cases, all measures that were proposed by the technical teams of Banco de Portugal were fully adopted by the Board of Directors of Banco de Portugal. Thus, the statements contained in the aforementioned report [from SIC, transmitted on Monday night] that the Bank of Portugal failed to initiate any infringement proceedings for violations that have been identified by the respective inspection teams are false”, read in the clarification disclosed.

The SIC report, broadcast in Jornal da Noite on Monday, about Angolan capital banks operating in Portugal, reported that Banco de Portugal inspectors detected serious problems in preventing money laundering and preventing terrorism in BIC, BNI banks and BPA and that for the three banks the technicians who carried out inspections proposed 38 administrative offenses.

According to SIC, two of the banks in question, BNI and BPA, say they have never received information on the application of administrative offenses.

In the case of BNI Europa (whose main shareholder is Mário Palhares, former deputy governor of the National Bank of Angola), SIC reported that at the end of the inspection in 2016, seven administrative offenses were proposed for serious violations of rules, but according to bank did not apply administrative offenses and did not even receive any administrative offense proposal.

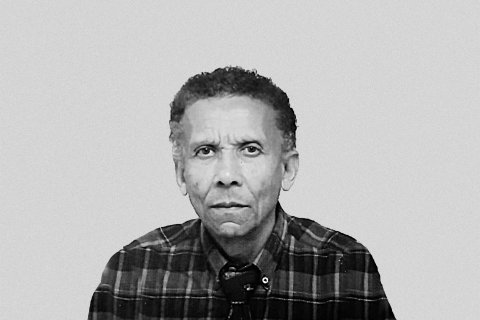

About Banco Atlântico Europa (BPA, whose main shareholder will, according to the report, Manuel Vicente, former vice-president of Angola), informed SIC that the conclusion of the 2016 inspection was evidence of serious gaps and failures in prevention money laundering and terrorism prevention, and eight administrative offenses have been proposed.

BPA told SIC that, in four years, no administrative offense was applied.

In BIC (currently under the name EuroBic) - whose main shareholder is Isabel dos Santos - the inspectors detected, in 2015, serious deficiencies in the prevention of money laundering and terrorist financing and 23 administrative offenses were proposed.

Since 2016, this bank has been led by Teixeira dos Santos, former Portuguese Finance Minister of the José Sócrates PS Government.

According to Banco de Portugal, "all the measures that were proposed by Banco de Portugal's technical teams were fully adopted by the Board of Directors of Banco de Portugal".

"The statements contained in that report are therefore false, that Banco de Portugal has failed to initiate any administrative offense for infringements that have been identified by the respective inspection teams," adds the clarification disclosed.

Still in the information, Banco de Portugal says that between 2015 and 2016 it carried out “a set of inspections of a transversal nature to various financial institutions operating in the Portuguese market, including the institutions mentioned in that report”.

It was as a result of these inspections, he adds, that nonconformities were identified and a “very significant set of measures” was taken, these being of a corrective nature (to remedy the shortcomings detected), substitutive (communicating the Bank of Portugal with the judicial authorities) and sanctioning (determination of conducts that can generate sanctions, through administrative infractions).

The bank regulator and supervisor also states that, since 2018, in the preventive supervision of money laundering and terrorist financing alone, it has carried out 32 inspections, issued more than 500 new measures and assessed about 800 measures resulting from previous inspections.

“In the same period, Banco de Portugal instituted 228 and concluded 312 administrative offenses, including several for violating the rules on the prevention of money laundering and terrorist financing”, he says.