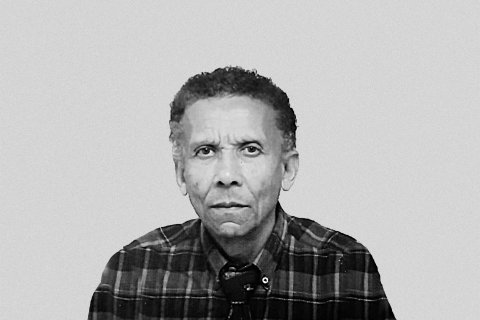

José de Lima Massano, who was responding this Wednesday as a plaintiff in the trial of the process of the undue transfer of 500 million dollars from the state to a bank in London, said that support was requested from the International Monetary Fund (IMF) in this regard, after the BNA had been pointed out as a bad example of governance, at a seminar on Central Bank Governance.

According to the governor of the BNA, in April 2019 during the annual meetings of the IMF and the World Bank he participated, together with the director of the country's Financial Information Unit (FIU), in that seminar, in which three examples of poor central bank governance were given.

"The first of the examples, unfortunately, was ours, and it was this particular operation, as it had occurred and as the press had reported," said the governor.

José de Lima Massano said that the country had twice received, for information gathering, agents from the UK's National Financial Crimes Agency, which opened an investigation following a complaint from HSBC bank in London.

This case, the governor of the BNA also pointed out, contributed to the loss of the banks, so that the regulator had to take a number of actions with them, demonstrating what was being done so that situations of this kind would not be repeated.

However, continued José de Lima Massano, some banks ended up closing their accounts, and the BNA was left with its image tarnished from the point of view of reputation.

The case dates back to 2017, when the defendant Jorge Gaudens Pontes Sebastião presented José Filomeno dos Santos, son of the former President, José Eduardo dos Santos, with a proposal for the financing of strategic projects for the country, which he forwarded to the executive, as he was not part of the Angolan Sovereign Fund, which he led at the time.

The proposal was presented to the executive to set up a Strategic Investment Fund, which would raise 30 billion dollars for the country.

The deal involved as a "previous condition", according to a government statement issued in April 2018, which announced the recovery of 500 million dollars, the capitalisation of 1.5 billion dollars by Angola, plus a payment of 33 million euros to set up the financing structures.

Two agreements were then signed between the National Bank of Angola and Mais Financial Services, a company owned by Jorge Gaudens Pontes Sebastião, a long-time friend of co-guardian José Filomeno dos Santos, one for setting up the financing operation. In August 2017, 500 million dollars were transferred to the PerfectBit account, "contracted by the promoters of the operation", for the purpose of custody of the funds to be structured.